Health Care Proxy

I don’t know about you, but I love a good trio. Some of my favorites include Luke, Leia, and Han Solo, Charlie’s Angels, s’mores, and the original Indiana Jones movies (those from before 2008).

However, my all-time favorite trio is the components that make up a successful estate plan.

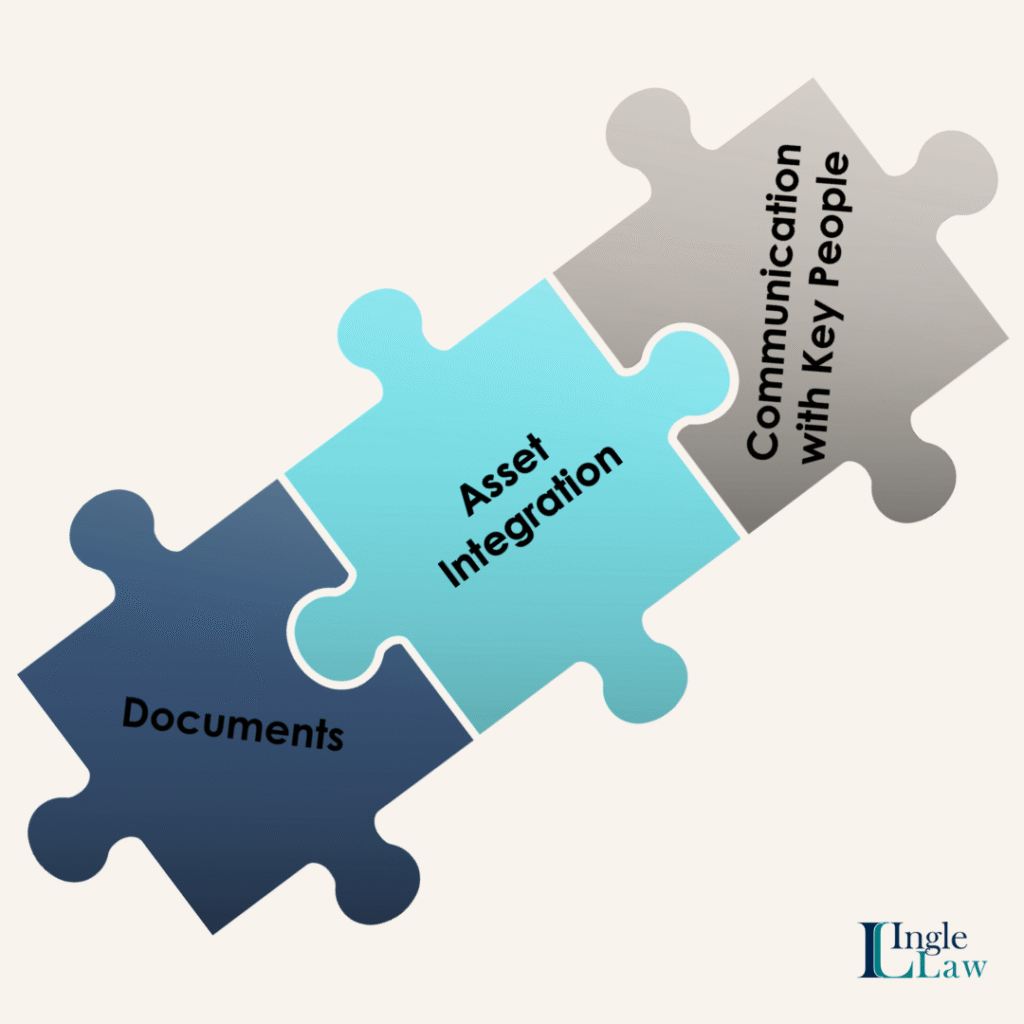

In our world, a successful estate plan has three components:

- Legal Documents

- Financial/Asset Integration

- Communication

If you want an estate plan that will actually work when your family needs it to, you must have all three. But here’s the thing – most attorneys only address the legal documents. Some might vaguely wave in the direction of financial integration with some generalized instructions and a ‘let me know if I can help’ email. I can count on one hand the attorneys who address the communication piece. The Dirty Secret about my industry is, lawyers profit when your plan doesn’t work, but more on that below.

Legal Documents Are Important—But They’re Not the Whole Plan

Legal documents like wills, trusts, powers of attorney, health care proxies, etc., are what most people envision when they think about creating their estate plan. The documents are key to a plan, but only one piece of it.

Legal documents are the written intent of your wishes for when you pass away or if you become disabled. But that’s all they are – your intent. Written documents alone are not a plan. They’re really just a pile of paper and a false sense of security.

Believe me, we’ve seen it time and time again: an attorney will mad-lib some legal documents, hand the client a pile of papers, and tell them to have a good day. The attorney never took the time to explain the documents, let alone what else the client should do to ensure their estate plan works when their family needs it most. Which is why you will often hear us say that legal documents alone are not in and of themselves an estate plan.

You Wouldn’t Leave Home without Your Wallet – So Why Are You Forgetting About Your Assets?

This is where we make sure the second member of our trio is addressed. I can tell you firsthand how much of a pain it is to deal with assets that were never addressed when creating an estate plan. My grandmother was a victim of the pile-of-paper lawyer. Her attorney set her up with a trust but never bothered to tell her she actually needed to put things into the trust.

When she passed, you could imagine my family’s surprise and annoyance when we saw the trust was empty. Instead of her goal of things being simple for her family when she passed, we ended up having to go through probate to retitle assets, which made an already tough time for our family so much worse (more here on the Terrible Surprise of an Empty Trust).

Any Estate Planning Attorney worth their fee will coach you on how to make sure your assets are aligned with your Plan to achieve your goals. This might involve retitling assets into a trust, double-checking named beneficiaries on life insurance and retirement accounts, or simply adding a pay-on-death beneficiary to bank accounts.

Skipping these financial integration steps will likely force your family through probate process. Just like that, they’ll be looking at a year (or more) of dealing with the court, thousands of dollars in expenses, and a public probate for the world to see. Or, worse yet, as much as an additional $225,000-250,000 in taxes!

Teams Don’t Win Games without Communication

When you create a plan, we want to ensure that the people who are key to the success of the plan have enough information to fulfill on their roles. When we discuss this component with our clients, we usually get two reactions.

The first is: “I don’t want them to know they’re named in my plan.” That’s totally understandable if you have worries that someone not named will be offended. But here’s the thing: if something happens to you and no one knows they’re supposed to step in, things can fall apart quickly. And let’s be clear, we’re not going to discuss distribution plans or assets and net worth. We’re just going to set some high-level expectations about who should be doing what and when.

The second is: “Oh, I’ve already told them they are going to be part of my plan.” That’s great! But do they actually know what to do when the time comes?

This is where communication really matters.

It’s important that the key people in your plan know:

- That there is a plan (yes, really!)

- They are key to the plan

- The initial steps to take when it’s time for them to take action

We’re With You Every Step

When we bring all three of these components together, we not only have a rocking trio, but an estate plan with the highest likelihood of success for when your family needs it most.

At Ingle Law, we are more comprehensive than other firms. We work through each of these components with our clients. We know this process can feel overwhelming. If you want to know more about what should be included in your plan, you can download our handy-dandy guide to estate plans through different stages of life.

Planning is important stuff. We want you to have all the information you need to feel confident you’re making smart decisions. We’ve designed a process to simplify everything and make sure we are with you, step by step. We’re here when you’re ready to get started.

No comments yet.